The contribution of farming to India’s GDP is 17 per cent. With over 60 per cent of the rural population still dependent on agriculture, the adoption and integration of technology can bring in a revolution in the sector and in the economy as well.

Despite India being a leading producer of several crops, there is much potential on improving the performance of the sector. This becomes even more significant since about 70 per cent of the agricultural households are small farmers. With the existence of 15 major climates in India and 46 of the 60 soil types, India also has the second-largest agricultural land globally, making it climatically and geographically one of the most challenging regions. The country is also one of the largest manufacturers of farm equipment such as tractors, harvesters, and tillers, accounting for about a third of the overall tractor production globally.

Both governments, as well as the private sector, are making efforts on improving the productivity and efficiency of Indian agriculture as they look at Farming-as-a-Service (FaaS) as a major disruptor. This is being seen akin to how SaaS, PaaS, and IaaS models have transformed the Information Technology industry in the last two decades.

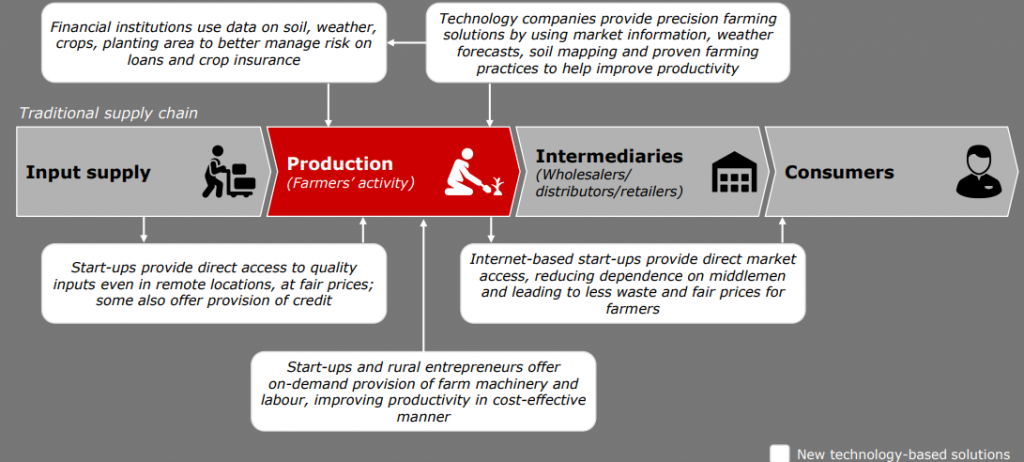

Adoption of FaaS model can bring forth farming-related advanced technological changes to facilitate in making farming a sustainable as well as profit-yielding enterprise. FaaS uses many business models, ranging from farm-to-warehouse, farm-to-mill, and farm-to-fork, linking farmers to the marketplace.

Another potential area of FaaS utility is cold chain, as farm produce is highly perishable by road or rail. Such start-ups can lead to extended shelf-life ensuring fresher produce, reduced losses, and lower logistics costs. FaaS promises to also result in sustainable food production to solve global food scarcity problems.

As per a report by the Bain & Company and IIM Ahmedabad titled ‘Indian Farming’s Next Big Moment: Farming as a Service,’ India’s mechanization lags behind significantly as compared to Brazil, Russia, the EU, and the US. The report emphasizes that the Private Sector can play a crucial role in redefining Indian agriculture by Infusing Capital, developing crucial infrastructure, and enabling access to markets and technological advancement.

What is Farming as a Service

FaaS provides innovative and professional solutions for agriculture services through a subscription model. These solutions also enable stakeholders to use data-based decisions for boosting efficiency and productivity. The service converts upfront costs to variable costs for farmers, making affordability a major boon for small farmers. FaaS provides analytics, information sharing, and precision farming tools.

The data can be garnered through satellites, drones, farmers, market agents as well as government agencies. The processed information can be harnessed by farmers for adopting precision farming practices. This can also be used by the government to empower field officers by giving timely updates and corporates to do real-time monitoring of crop output.

Additionally, production assistance such as skilled and unskilled labour based on demand by the farmers and utility services like grid electricity and water services are also facilitated through FaaS Services.

Pay-per-use model is not entirely new as many farms have made a cooperative for buying and sharing specific equipment. Since the product purchase can be expensive, it is both convenient and affordable to lease them for a specific fee. It can also enable farmers to control costs, especially during times of pressure and high debt. FaaS can also result in mitigating environmental concerns, augment financial inclusion, increase digital penetration and encourage rural entrepreneurship.

*source: BCG Report

India Startup Ecosystem in FaaS

The Indian startup system has quickly realized that agriculture is a powerful opportunity both to make an impactful difference and scale-up solutions. Currently, the aggregate investor funding for FaaS solutions is at USD 105-115 million. Some of the major investors in FaaS include Accel Partners, IDG Ventures, Aavishkaar, Global Innovation Fund, IvyCap Ventures, Sophia Investment ApS amongst others.

Agribolo, a farmer engagement startup, engages farmers with the marketplace through the adoption of farm-to-mill, farm-to-fork, and farm-to-warehouse models. The firm has already engaged over 2.5 lakh farmers across the country as it aims to reduce the farm interest rate from 24 percent to 10 per cent per annum.

Another interesting start-up is in the supply chain, Ninjacart, connecting food producers directly with restaurants, retailers as well as service providers using in-house applications.

Oxen Farm Solutions is another venture, which aims to provide a thrust to India’s agricultural productivity by bringing different stakeholders-farmers, farming equipment manufacturers as well as government policies on a platform. The firm is also using satellite images to look into the health of crops.

Another startup Gold Farm enables farmers to access any farm equipment through a mobile app, enabling both farmers and tractor owners to profit by connecting them through the app. Till date, the firm has converted over 7,500 hectares of barren land helping plough and harvest over 25,000 hectares of land across two districts in Karnataka. Fasal, a Climate Smart Precision Agriculture Solution provider, provides higher incomes to farmers and lesser price to retailers through an efficient supply.

Established institutions such as TAFE, Mahindra & Mahindra, and John Deere have also begun experimenting with a pay-per-use model for tractors and other farm equipment. M&M launched Trringo, aiming to rent farming equipment to farmers at affordable rates in the country. Trringo has supported over one lakh farmers across Karnataka, Madhya Pradesh, Maharashtra, and Rajasthan.

Some other key players in India in the Faas segment include Ulink Agritech Pvt Ltd, Cropin Technology Solutions Pvt Ltd, RML Information Services Pvt Ltd, Intello Labs, Utkal Tubers India, and KhetiBuddy Agritech Private Limited.

Global FaaS Market

As per the Global Farming as a Service Market Research Report: Forecast (2021-2026), the market is expected to grow at a CAGR of around 15.3 per cent in the next five years. The growth will be driven by the augmenting need for adopting advanced agriculture technologies for boosting productivity. Adoption of FaaS will increase in the coming times due to higher productivity and efficiency through data-driven decisions.

Globally, governments have begun encouraging adoption of FaaS solutions for helping farmers overcome challenges faced by farmers, like lack of access to technology, dependence on rainwater for irrigation as well as high cost of machinery. In terms of geography, North America is ahead in the service due to industry players offering best-in-class equipment and service to offer.

US-based Sabanto is a pioneering Agtech company, known for innovative autonomous farming equipment, including tractors and planters. The machines are fitted out by the company, making the humble tractor a robot. Importantly, the model ensures no cost of ownership to farmers and minimal human interaction. This has allowed farming operations to become cheaper and faster.

Spanish company Libelium provides IoT solutions, such as sensors, to a number of industries including agriculture. The firm makes products to track temperature, humidity, and pressure through its smart agricultural platform. Additionally, it has made a crop control and monitoring system as part of a joint venture with Microsoft Azure and Integra.

Greek startup Agroapps gives a number of services to facilitate farmers in improving and managing businesses. The company provides advisory services to help farmers through a number of climate and weather forecasting services. On the other hand, a French AgriTech startup Ekylibre combines a number of solutions to maximize productivity from crops and livestock.

Farmlyplace, a German startup guides partners in design, planning, marketing, and operation of modular farm systems by utilising up-cycled logistics containers to locally produce and sell fresh produce.

Traditional firms are also moving towards FaaS. An example is the Case New Holland, which acquired AgDNA, a management software platform. CNH also launched AGXTEND, which focuses exclusively on aftermarket precision farming technology solutions.

The scope of leveraging the economic potential of farming through Faas augurs well not only for employment generation but also for growth.