AGRICULTURE, The Next Big Opportunity

Despite India’s dominent position as a producer in word agriculture, India has a Meager 1.5% share of global agritrade.This is because both, productivity levels(yields) as well as the level of food processing in India,continues to languish below that of comparable geographies. Thus,the potential for growth in this sectior is huge and could in turn trigger growth of the intire economy, driving GDP growth. Recognizing this potential, the government has decided to step up investments in this sector, open it up to the private sector by premitting contract farming which should see the growth rate of the agricultural sector more than double over the next few years helping India achieve a GDP growth of 8%.

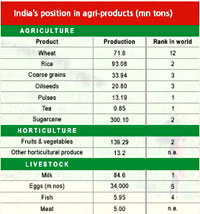

India occupies a dominant position in world agriculture. In India, 52% of total land is cultivable as against 11% which is the world average. Also, of the 60 soil types in the world, India has nearly 46. India thus has the second largest gross cropped area (160 mn hectares) and is a leading producer of cereal crops, pulses, tea, jute and allied fibres and fruits & vegetables. It also has the second largest livestock population in the world and is the largest producer of milk in the world. In fact, India accounts for 17% of the animals, 12% of the plants (including over 10,000 species of aromatic and medicinal plants) and 10% of fish genetic resources of the world.

But India’s share in international food trade is negligible. India accounts for less than 1.5% of international food trade. There are several reasons for this. Firstly, the agricultural sector is largely unorganized, dominated by small farms (in all 100 million, with farm size of less than 1.2 hectares divided into 3-10 separate plots), which constrains productivity levels or yield per hectare. Secondly, very little of the food that is produced is processed thanks to the food processing industry also being largely unorganized. Small players, which process less than 0.5 tons/day and aggregating around 9,000 units, account for bulk (~75%) of processed food output.

But India’s share in international food trade is negligible. India accounts for less than 1.5% of international food trade. There are several reasons for this. Firstly, the agricultural sector is largely unorganized, dominated by small farms (in all 100 million, with farm size of less than 1.2 hectares divided into 3-10 separate plots), which constrains productivity levels or yield per hectare. Secondly, very little of the food that is produced is processed thanks to the food processing industry also being largely unorganized. Small players, which process less than 0.5 tons/day and aggregating around 9,000 units, account for bulk (~75%) of processed food output.

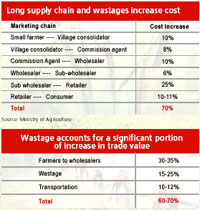

Thirdly, the value of wastages in food grains and fruits & vegetables is estimated at over Rs50,000 crore, as the food chain from the farmer to the consumer involves several intermediaries with multiple-point handling and long transit periods. And this in turn increases the cost differential between the mandi (wholesale) price and the market price to 60-100% or more. Fourthly, with government funding to the sector proving grossly inadequate and liberalization withheld, capital formation saw a negative growth.

These shortcomings constrained the growth of the agricultural sector, which has seen a deceleration from 3% in the 1980s to just 2% over the last 10 years, even while its counterpart the services sector grew at a rate of over 7.5%. Considering that agriculture accounts for 35% of India’s GDP and nearly 65% of employment, even if the growth rate in agriculture were to double, it could spur growth in GDP to over 8%, both directly through increase in agricultural production as well as indirectly though growth in rural consumption.

These shortcomings constrained the growth of the agricultural sector, which has seen a deceleration from 3% in the 1980s to just 2% over the last 10 years, even while its counterpart the services sector grew at a rate of over 7.5%. Considering that agriculture accounts for 35% of India’s GDP and nearly 65% of employment, even if the growth rate in agriculture were to double, it could spur growth in GDP to over 8%, both directly through increase in agricultural production as well as indirectly though growth in rural consumption.

India’s gross cropped area of 160 mn hectares nearly equals the size of US farmland and is larger than that of Europe and China. But with only ~40% this land being irrigated, agriculture production has grown at a rate of just 2.7% per year over the last 40 years. It israte of just 2.7% per year over the last 40 years. It is estimated that a 1% increase in irrigated area generates a 1.6% increase in crop output and a RoI of 17%. Realizing this, the Indian government has been making a concerted effort to increase gross cropped area under irrigation including offering irrigation projects on BOT basis. It is also opening up the sector by allowing corporates to undertake (i) Contract Farming, (ii) Supply Chain Management, (iii) Agro Retailing and (iv) Food Processing on a larger scale.

To facilitate the same the government has asked states to change their APMC Act (which required all agricultural products to be sold only in government regulated markets) and linked credit flow to the same capital investment subsidy for renovation of godowns and setting up farm marketing infrastructure will only be given to states that have amended the APMC Act. Fourteen states and four Union Territories have already amended the APMC Act which allows farmers to sell their produce directly to buyers. Meanwhile, another six states have undertaken partial reforms and 13 states along with three Union Territories have initiated action on the reforms front.

Contract Farming

Despite India’s leading position in world production, it lags behind in productivity (yields). In fact, though India ranks second in rice and wheat production, in terms of yield/hectare it ranks 52 (rice) and 38 (wheat). For pulses the productivity levels drop even further. Despite being the highest producer of pulses in the world, India ranks 138 in terms of productivity. To improve yields in agriculture, the government has allowed the private sector to undertake contract farming. This, the government believes will result in increase in seed replacement (from 12% to 20%), farm mechanization (from 25% to 40%), fertilizer (NPK) use (from 91.5 kg/ha to 160 kg/ha) and IPM coverage (from 5% to 15%) apart from improving cropping intensity from 134% to 145%. According to the Agricultural Ministry, reforms in the agricultural sector are likely to see total food grain production rise from 203.41m ton in 2000-01 to 320.0m ton by 2011- 12, registering an annual growth of over 4%, while for horticultural produce the growth would be even higher from 152.5m ton in 2000-01 to 300m ton in 2011-12, a growth of over 6% p.a.

Despite India’s leading position in world production, it lags behind in productivity (yields). In fact, though India ranks second in rice and wheat production, in terms of yield/hectare it ranks 52 (rice) and 38 (wheat). For pulses the productivity levels drop even further. Despite being the highest producer of pulses in the world, India ranks 138 in terms of productivity. To improve yields in agriculture, the government has allowed the private sector to undertake contract farming. This, the government believes will result in increase in seed replacement (from 12% to 20%), farm mechanization (from 25% to 40%), fertilizer (NPK) use (from 91.5 kg/ha to 160 kg/ha) and IPM coverage (from 5% to 15%) apart from improving cropping intensity from 134% to 145%. According to the Agricultural Ministry, reforms in the agricultural sector are likely to see total food grain production rise from 203.41m ton in 2000-01 to 320.0m ton by 2011- 12, registering an annual growth of over 4%, while for horticultural produce the growth would be even higher from 152.5m ton in 2000-01 to 300m ton in 2011-12, a growth of over 6% p.a.

Allowing corporates to undertake contract farming has seen the entry of large players like PepsiCo India Holdings, Bharti TeleVentures, HLL (which works in consortium with Rallis which provides agri-inputs and know how and ICICI which gives farm credit), Tata, DCM Shriram and McDonald’s among others. In the case of PepsiCo, which has 75,000 acre of holdings across states on which nearly 200 farmers grow corn, tomatoes, basmati and potatoes, contract farming led to savings of 20-30% apart from ensuring steady and adequate supply of raw material for its food processing plants. In fact, PepsiCo’s foray into contract farming in Punjab was on account of inadequate supply the company required 40,000 ton of tomatoes over 55 days to operate its tomato processing plant but the state could provide only 28,000 tons in one season (28 days).

However, the total area currently under contract farming covers only 7 million acres of the total cultivable land of 400 million acres, accounting for less than 2%. And even this figure drops to 200,000 acres if only corporate contracts are considered. While contract farming is attracting more players like Reliance Industries, retail chains like Big Bazzar and Metro, the challenge will be to integrate farmers as benefits of scale and technology can be achieved only on minimum 3-4 acre plots.

Supply chain management: key to profit maximization

The long supply chain starting from harvesting, packing, grading, transportation, storage, wholesale and finally retail sale involves very little value addition but huge losses in terms of wastage (15-25% is lost by the time the produce reaches the retail level). In value terms, the wastage in food grains (including post harvest losses) is estimated at over Rs50,000 crore a year. For fruits and vegetables (where post harvest loss is higher at 25-30%) it is estimated at over Rs 23,000 crores.

Further, despite little or no value addition, the price of the commodity increases by nearly 100% from the farm-gate to the retail stage, with neither the farmer nor the consumer benefiting. The share of the rice grower in the final price paid by the consumer is usually not more than 44-47%. And for fruits and vegetables the farm gate price as percentage of retail price is even lower at 25% compared to 70% in USA. According to a study conducted by Rabo India Finance, farmers share could increase to 33% of total revenues on an average after disintermediation in the supply chain, while consumers would save 10% of their spends on food if supply chain efficiencies were improved.

Terminal market complexes: As a step towards reducing wastage and increasing share of producers in price, the government has encouraged corporates to set up TMCs. TMCs offer multiple choice to farmers such as electronic auctioning and direct sale to exporters, processors and retail chains under one roof. In addition wastage is reduced as TMCs provide storage infrastructure (giving participants the choice to trade at a future date), logistics support including transport and cold chain services and cleaning grading and packing support to farmers. The TMCs would operate on a Hub & Spoke format with the TMC (the Hub) linked to a number of collection centers (the Spokes) located at key production centers. Corporates that have expressed interest to set up TMCs include Reliance Industries and ITC, which plan to invest between Rs60 crore to Rs120 crore on each TMC. In all, eight TMCs are likely to be set up in centres like Mumbai, Nasik, Patna, Chandigarh, Rai (Haryana), Bhopal, Nagpur and Kolkata. The area covered would vary from 200 acres (for Mumbai) to 55 acres (Kolkata). And the handling capacity in each TMC would range from 200,000 ton to 600,000 ton (for Mumbai) a year.

Information technology to aid growth

The Agricultural Ministry with the help of the National Informatics Centre has promoted on-lineagricultural markets for crops and horticultural produce.

Agmarknet: To ensure that farmers get a fair price for crops, the Agmarknet has sought to network all major agricultural producer markets, agricultural marketing boards and departments and wholesale markets in the country. Along the same lines it has also promoted Hortnet a horticulture informatics network (though this has been taken up on a turnkey basis with the hub having been set up at the National Horticultural Board, Gurgaon, to which 33 countrywide market centers of the Board areconnected. Prices and arrivals of fruits and vegetables are received by NHB on a daily basis from the 33 centres. To improve productivity at the farm level and help in efficient dissemination of information it has also set up a crops informatics network (Cropsnet), a plant protection network (PPIN) and a fertilizer informatics network (Fertnet).

The success of introducing IT in agricultural marketing can be gauged from the fact that Agmarknet, which has set a target of connecting 2810 market nodes in the 10th plan, has already connected 2408 nodes.

E-choupal: ITC has also made a significant contribution to the growth of e-markets. ITC’s echoupal network is today the largest network in the country with over 6,000 kiosks in operation. It has already connected more than 30,000 villages across six states and is growing at a hectic pace, entering 30 new villages a day. In recognition of its contribution to the field of information technology, the company recently received the prestigious Development Gateway Award, an international award recognizing outstanding achievement in the application of information and communication technologies.

Commodity markets have provided price transparency

Multi-commodity exchanges like MCX, NCDEX and NMCEIL, which have seen rapid growth since 2003, have provided greater price transparency in agro commodities by putting producers, end-users and retail investors on the same platform and aid in price discovery. Currently, over 70 agri commodities are actively traded on the multi-commodity exchanges with average daily trading volumes at times crossing volumes in capital market futures in August 2005, volumes on the MCX crossed Rs10,000 crore. MCX has also set up the country’s first National Spot Exchange for Agricultural Produce (NSEAP) along with NAFED (National Agriculture Cooperative Marketing Federation of India Ltd), which connects all APMC markets of India electronically.

Food processing: moving up the value chain

The turnover of the total food market in India is estimated at Rs250,000 crore (US$69.4 billion) according to a recent Mckinsey-CII study, but processed food accounts for only Rs80,000 crore or 32% of the food market. This is because India processes less than 2% of its horticultural produce (fruits and vegetables) compared to 70% in Brazil and 78% in the Philippines as per data published by the Planning Commission in January 2005. Further, with value addition languishing at 7% vis a vis countries like China where it is 23% and Philippines where it is 45%, the scope for growth in this sector is enormous. In fact, going by CII estimates, the sector is expected to grow at a rate of 9-12% per annum on the back of 6-8% growth in GDP. According to a Mckinsey-CII study the food processing sector is likely to attract investments of Rs150,000 crore (US$33 billion) over the next 10 years. The Ministry of Food Processing expects investments in food processing to act as a catalyst and improve the share of value addition to 35% by 2015, improving the level of processing to 20% over the same time frame.

Sensing the sector’s potential, the government has offered several sops to the industry apart from liberalizing the sector (licensing has been abolished for almost all kinds of food processing except for some products like beer, liquor, cane sugar and automatic approvals are granted for 51% of foreign equity or 100% for ventures set up by NRIs/OCBs). Next on the government’s agenda is to set up agrizones and mega food parks. To implement the Food Parks Scheme the Ministry of Agriculture has already released Rs105.22 crore (US$23 million) as assistance and has so far approved setting up of 100 food parks throughout the country of which it plans to back 50. Meanwhile, 20 mega parks are being set up in various cities primarily to attract FDI. The Centre plans to give Rs 100 crore (US$22 billion) by way of subsidy for setting up such mega food processing parks.

Organized retail will provide further impetus

Ernst & Young ranks India’s retail sector first among emerging markets for international retail. According to Ernst & Young, though the organized sector constitutes only 3% of the $230 billion Indian retail market, it is expected to grow 400%from $7 billion currently to over $30 billion by 2010. Interestingly, hypermarkets will drive most of this growth. Considering that hypermarkets account for a share of over 50% in retail distribution of food in developed countries, the growth in hypermarkets would in turn drive agri commodity and processed food sales. In fact, over the next 5-6 years food and grocery revenues of the organized retail sector are likely to multiply five-fold according to Cris Infac, capturing a 30% share of the domestic food and grocery market as against 1% currently.

The growth in hypermarkets is not confined to urban areas alone. For instance, ITC, the first company to set up a rural mall at Sehore in MP, was spurred by its success and now plans to open 30 more such malls (each costing Rs5 crore on an average) in 2005-06, in synergy with its fast growing e-choupal network. Of the 30, nine malls (three each in Maharashtra, Madhya Pradesh and Uttar Pradesh) are likely to be opened within the next few months.

Until now, lack of investments had hampered the growth of agriculture and food-processing in India. But with the government according both these sectors priority status, this is set to change. Investments in both these sectors and in supply-chain management have started pouring in and it’s only a matter of time before the India emerges as a significant player in agriculture and food-processing sectors.